Does the World Cup give Penny Stocks the Boot?

Typically in America many sports fan are not only skeptical of the World Cup, but of soccer in general. However, in Europe and most of the world it’s a blue chip sport. To some it’s the only sport. Consequently, dominating foreign news headlines and European interest. But it’s over on Sunday. What’s the next hot news cycle in Europe? I’d say the European bank stress test results which are due out in roughly two weeks. The US markets have gone through this once and these tests provided a lot of uncertainty to our markets.

Typically in America many sports fan are not only skeptical of the World Cup, but of soccer in general. However, in Europe and most of the world it’s a blue chip sport. To some it’s the only sport. Consequently, dominating foreign news headlines and European interest. But it’s over on Sunday. What’s the next hot news cycle in Europe? I’d say the European bank stress test results which are due out in roughly two weeks. The US markets have gone through this once and these tests provided a lot of uncertainty to our markets.

Now does this filter down from the FTSE and NYSE to the OTCBB? It could for one reason. That reason is called liquidity. Summer volume is typically low already and the pending stress test results will most likely get lots of play on CNBC, FOX Business News, etc. Now what that means to the retail investor who plays penny stocks is simple. In times of uncertainty, he usually buys less if at all. Penny stock traders may be able to take advantage of this uncertainty on the other hand. Investors could be waiting for companies that were once hot penny stocks to wash out to a cheap level if the stress tests wreck the market. On the other hand, the results of these banks could already be factored in and we could see a flat market.

Unemployment rates in Portugal, Ireland and Spain are already at or near historic highs. The news may be already baked into the cake. So be ready as always. If we do see a sharp correction some quality penny stocks could dip and give you an opportunity to profit in a fast trade based on somebody else’s weakness. So have your penny stock list locked and loaded and always be ready to pull the trigger if it makes sense.

Dog Days of Summer for IPO Market ?

Many of you know, from previous entries that the Tesla IPO (NASDAQ:TSLA) was a wild ride and offered huge gains to many who bought in the aftermarket. However, this week is no different from years past. Using the word slow is an understatement. Consequently, Fortune Bank IPO (NASDAQ:FBBC) is the only new issue scheduled to trade this week. The outlook for the deal is a mild premium and in no way can be confused with Tesla Motors Inc which provided many with the volatility and excitement that you can find in penny stocks. Next week will be a little more active with three deals scheduled to price. Business software company, Qlik Technologies IPO (NASDAQ:QLIK) is thought by some to trade at a decent premium. Real ID (NYSE:RLD) is also expected to trade at a nice premium.

Many of you know, from previous entries that the Tesla IPO (NASDAQ:TSLA) was a wild ride and offered huge gains to many who bought in the aftermarket. However, this week is no different from years past. Using the word slow is an understatement. Consequently, Fortune Bank IPO (NASDAQ:FBBC) is the only new issue scheduled to trade this week. The outlook for the deal is a mild premium and in no way can be confused with Tesla Motors Inc which provided many with the volatility and excitement that you can find in penny stocks. Next week will be a little more active with three deals scheduled to price. Business software company, Qlik Technologies IPO (NASDAQ:QLIK) is thought by some to trade at a decent premium. Real ID (NYSE:RLD) is also expected to trade at a nice premium.

The remaining IPO on the syndicate calendar is the Canadian company Smart Technologies IPO (NASDAQ:SMT) which IPO services say may trade at a small premium. Keep in mind that Tesla traded higher on a big down day in the market. While you never know how new issues will trade, quality offering can still trade at premiums in bad markets. The best thing to do is form a list and be prepared. It doesn’t matter whether your investing in an IPO list or a penny. Being prepared to act is the key. Remember there is an Tesla aftermarket buyer who was filled @ 17.54. That buyer had the opportunity to sell the stock over $30 the next day. Now that is a massive gain! I think it’s safe to say that some of those Tesla aftermarket buyers did their homework. IPO’s and penny stocks can offer huge gains and we are always looking for the next huge winner.

Tesla IPO and Its Wild Ride

Tesla IPO and Its Wild Ride

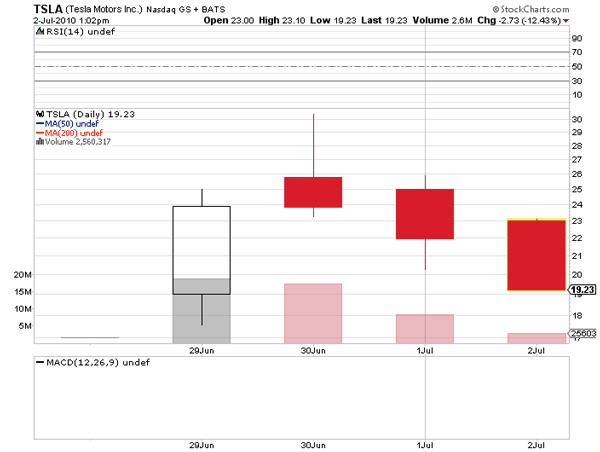

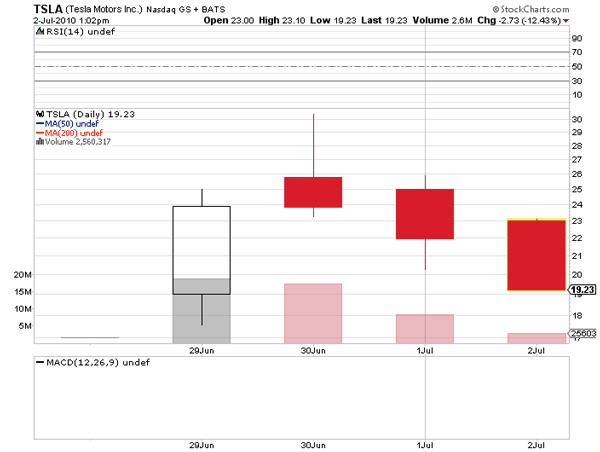

Going into the long weekend, it seems that shares of Tesla (NASDAQ:TSLA) have come back to earth. IPO shares of TSLA were priced at $17 and surged to 30.42 on it’s second day of trading. A massive gain considering that traders had time to buy aftermarket shares under $18. Was a lesson learned here for investors who paid more than $25 ? Yes, I think so.

TSLA is a company that has a great CEO, a cutting edge product and has never had problems raising money despite being unprofitable. However, the saying “What goes up must come down” came into play on TSLA. It’s probably safe to say that some of the aftermarket buying came from buyers who have a legitimate long term perspective. These are investors who are investing with a horizon so long that makes paying a point or two higher almost irrelevant. But what was the short term trader thinking at $30 a share ? Buying TLSA for a short term after it’s huge run is a classic example of why it’s sometimes better to sit on your hands. While the company has tremendous potential, the market mechanics remain the same.

It doesn’t matter if it’s a blue chip on the NYSE, a mid-cap or an OTCBB issue. Smart traders will always take profits. The lesson learned here is not to chase stocks that have made huge moves in short time frames. Looking at charts and decreasing volume at the highs is key. This applies not only to TSLA, but to hot penny stocks too that are on the move.

iPhone 4

Apple (NASDAQ:AAPL) just announced last weekend that sales of the iPhone 4 had reached 1.7 million units. The launch of the new product was staggering. Now how does the new product impact penny stocks? Stocks on the OTCBB often can do better as a whole if the broader market averages are higher. An investor who looks for hot penny stocks is more apt to speculate if his core holdings (Blue Chips, Mutual Funds etc.) are doing well. Basically higher averages on the NYSE and the NASDAQ usually bring more liquidity into micro cap stocks.

Currently, AAPL is trading about 20 points off of it’s all time high and the shares have pulled back sharply in the last few trading sessions. Many major brokerage firms have price targets on the stock that would provide massive gains if they were met. If the brokerage firms are right in their analysis, smaller stocks could benefit. As mentioned before in prior blogs, many penny stocks try to attach themselves to AAPL by announcing new Apps. There are dozens of companies that are constantly receiving revenues from larger companies like AAPL, GOOG and RIMM.

Sometimes this works and sometimes it doesn’t. Many large cap names that make parts for the iPhone 4 are also sensitive in a different way. The movement of these names is more earnings related. Going forward, keep your eye on the sales updates from AAPL. There might be a trading opportunity in a penny stock that was previously idle or even dead. Look at the gaming and social media companies in particular. Being ready is the key and if nothing develops, all you have lost is time.

iPhone-4g

BP Stock Price and the affect of the Oil Spill

We all know that every time there is a worldwide event, investors have a chance to capitalize and make money in the markets, especially when it comes to an environmental disaster. The news bring a lot of attention to the stock market. It happened with the Exxon Valdez and Katrina. Now it’s happened again with larger companies like British Petroleum (BP), Transocean Ltd (RIG) and Halliburton (HAL) have been punished. Every time an event like this happens, several penny stocks come into play. Shares of MOPN took off after they received a purchase order from BP for their MOP Maximum Oil Pickup product.

We all know that every time there is a worldwide event, investors have a chance to capitalize and make money in the markets, especially when it comes to an environmental disaster. The news bring a lot of attention to the stock market. It happened with the Exxon Valdez and Katrina. Now it’s happened again with larger companies like British Petroleum (BP), Transocean Ltd (RIG) and Halliburton (HAL) have been punished. Every time an event like this happens, several penny stocks come into play. Shares of MOPN took off after they received a purchase order from BP for their MOP Maximum Oil Pickup product.

Other penny stocks like EVTN and EVXA also received a large amount of attention from the environmental disaster. All of these companies instantly became hot penny stocks. You should throw these three companies on your penny stocks list and keep an eye on them. Many investors will try to buy familiar names that historically react favorably oil spills. Longer term investors may buy companies like MOPN and EVTN and are hoping for a home run while penny stock flippers and day traders step in and provide constant liquidity.

In the end though only a select few of these names actually benefit from these disasters financially. Only a few contracts are actually given out, so be selective. Keep in mind that profit might be short lived so be prepared to take a quick scalp. Once again the key is being prepared. You need to know which stocks move based on an event. So have your lists of blue chips, mid-caps and penny stocks ready, and be ready to pull the trigger.

How Will This Effect Penny Stock Trading?

Today the Federal Reserve was once again true to their word. The benchmark interest rate remained unchanged. The FOMC also mentioned that while the U.S. economy is improving, problems in Europe could slow down growth in America.

Today the Federal Reserve was once again true to their word. The benchmark interest rate remained unchanged. The FOMC also mentioned that while the U.S. economy is improving, problems in Europe could slow down growth in America.

Many large brokerage firms feel that due to the problems abroad, a rate hike here in the U.S. is unlikely until sometime next year. To me, that sounds like it makes good sense. Now, how does that affect penny stocks and companies that trade on the OTCBB.

Well, historically small cap and micro cap companies do better in low interest rate environments. This is due to the low cost of borrowing and more readily available supplies. But as you have probably read here before, hot penny stocks usually make huge moves based on a positive news release or an event related to the stock. Unlike Intel (INTC) or Disney (DIS), the big percentage gainers on the OTCBB or Pinksheets generally don’t move in sympathy with the S&P 500 or the NASDAQ 100.

Do your homework if you are looking for the next hot penny stock. You will not get a signal from Bernanke or the broader market to find the next penny stocks to watch. Low interest rates don’t hurt, but the biggest winners have come from special situations. Not from the Fed.

Check back for more blog entries and look for our next hot penny stock alert.

“Short Squeeze”

Today let’s talk about the penny stock short squeeze. This is something that happens a lot in the penny stock game. A short squeeze is definitely more likely to happen in a company with a small market cap and a small float. It is harder for a company with a billion dollar market cap to move than it is for a company with a $75 million market cap.

This is the simple concept of supply and demand. When an investor has a short position in a stock it simply means that they are betting that the company is going to decrease in value. This is not really a long shot with 99% of penny stocks out there!!

This is the simple concept of supply and demand. When an investor has a short position in a stock it simply means that they are betting that the company is going to decrease in value. This is not really a long shot with 99% of penny stocks out there!!

When a short squeeze happens in a penny stock, all hell can break loose with the price of the shares. If there is a large short position in the stock and the price of the stock increases, the shorts may be forced to cover. They either want to cut their losses or have to fulfill margin requirements. When the cover the stock, they are actually buying the stock back. This can make the stock jump even further and trigger off more margin calls and creates more buying. It is somewhat of a domino effect.

Take a look at any penny stocks that you own and see if they are on this list and how many shares are short compared to the float.

This is a great penny stocks list for potential investors to take a look at.

Adding the “Q” to WAMU – From a Blue Chip to a Penny Stock

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying hot penny stocks with good prospects and buying a Zombie Stock.

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying hot penny stocks with good prospects and buying a Zombie Stock.

A Zombie stock is generally a company that is near bankruptcy. When the market crashed in 2009 blue chip companies like General Motors, Washington Mutual, Lehman Brothers and AIG filed bankruptcy, causing both retail investors and institutions to take massive losses.

Consequently, these stocks were delisted from the NYSE and traded on the Pink Sheets. They are now classified as “Zombie Stocks“. Now don’t get me wrong there is a niche market for these types of securities. There are investors who flip penny stocks everyday. They move in an out of the stock trying to scalp a 2 to 10% gain. There are also other retail investors who generally are not active penny stock buyers, that will step in on fallen blue chips and view the investment as you would a lottery ticket. Some catalysts for buying Zombie Stocks are massive liquidity and news sensitivity. While most people who engage in this practice eventually lose money, there are some who double, triple or even quadruple their funds in a very short time period. While some view stocks like WAMUQ as a trading paradise, there are probably easier ways to make money in the market.

Consequently, these stocks were delisted from the NYSE and traded on the Pink Sheets. They are now classified as “Zombie Stocks“. Now don’t get me wrong there is a niche market for these types of securities. There are investors who flip penny stocks everyday. They move in an out of the stock trying to scalp a 2 to 10% gain. There are also other retail investors who generally are not active penny stock buyers, that will step in on fallen blue chips and view the investment as you would a lottery ticket. Some catalysts for buying Zombie Stocks are massive liquidity and news sensitivity. While most people who engage in this practice eventually lose money, there are some who double, triple or even quadruple their funds in a very short time period. While some view stocks like WAMUQ as a trading paradise, there are probably easier ways to make money in the market.

Typically in America many sports fan are not only skeptical of the World Cup, but of soccer in general. However, in Europe and most of the world it’s a blue chip sport. To some it’s the only sport. Consequently, dominating foreign news headlines and European interest. But it’s over on Sunday. What’s the next hot news cycle in Europe? I’d say the European bank stress test results which are due out in roughly two weeks. The US markets have gone through this once and these tests provided a lot of uncertainty to our markets.

Typically in America many sports fan are not only skeptical of the World Cup, but of soccer in general. However, in Europe and most of the world it’s a blue chip sport. To some it’s the only sport. Consequently, dominating foreign news headlines and European interest. But it’s over on Sunday. What’s the next hot news cycle in Europe? I’d say the European bank stress test results which are due out in roughly two weeks. The US markets have gone through this once and these tests provided a lot of uncertainty to our markets.

Many of you know, from previous entries that the

Many of you know, from previous entries that the  Tesla IPO and Its Wild Ride

Tesla IPO and Its Wild Ride

We all know that every time there is a worldwide event, investors have a chance to capitalize and make money in the markets, especially when it comes to an environmental disaster. The news bring a lot of attention to the stock market. It happened with the Exxon Valdez and Katrina. Now it’s happened again with larger companies like British Petroleum (BP), Transocean Ltd (RIG) and Halliburton (HAL) have been punished. Every time an event like this happens, several penny stocks come into play. Shares of MOPN took off after they received a purchase order from BP for their MOP Maximum Oil Pickup product.

We all know that every time there is a worldwide event, investors have a chance to capitalize and make money in the markets, especially when it comes to an environmental disaster. The news bring a lot of attention to the stock market. It happened with the Exxon Valdez and Katrina. Now it’s happened again with larger companies like British Petroleum (BP), Transocean Ltd (RIG) and Halliburton (HAL) have been punished. Every time an event like this happens, several penny stocks come into play. Shares of MOPN took off after they received a purchase order from BP for their MOP Maximum Oil Pickup product.

Today the Federal Reserve was once again true to their word. The benchmark interest rate remained unchanged. The FOMC also mentioned that while the U.S. economy is improving, problems in Europe could slow down growth in America.

Today the Federal Reserve was once again true to their word. The benchmark interest rate remained unchanged. The FOMC also mentioned that while the U.S. economy is improving, problems in Europe could slow down growth in America.

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying  Consequently, these stocks were delisted from the NYSE and traded on the

Consequently, these stocks were delisted from the NYSE and traded on the