Volume and Liquidity

Penny stocks can will often gain or decrease in value with even the slightest provocation. This can happen with no news or even a limited trading history in the stock. Even if you see a penny stock up 200% in a day, it does not mean that it’s a hot penny stock.

Lets say that there is an investor who loves gold penny stocks. He loves the gold market and thinks that a gold company is a good place to park his assets rather than buying the hard commodity. He wants the most bang for his buck, so rather than invest his $10,000 in Newmont Mining (NEM) he looks for a cheap penny stock.

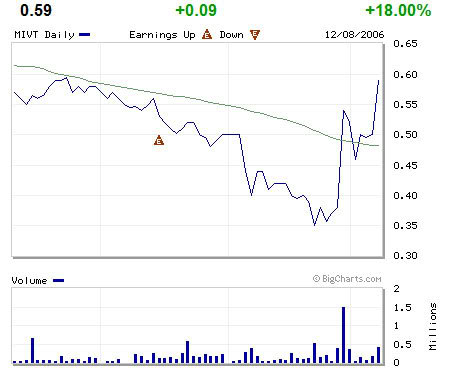

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

A major part of the process while investing in a penny stock is to understand what driving factors are taken into consideration in the price of penny stock shares. If a penny stock jumps high on very little volume, chances are something like I just mentioned happened.

This is why you must put together a list of penny stocks and take your time to do research on each individual company.