Penny Stock Trading

Many people are attracted to penny stocks because of their potential to provide massive gains. However, many novice traders and investors often get involve in speculative investments without having a strategy set in advance.

People often look to buy hot penny stocks because of their low price and the ability to own large share amounts with only a small amount of capital. Penny stock buyers should know that trading strategies should be the same, regardless if you are buying Cisco Systems (NASDAQ:CSCO) or a mining stock on the OTCBB. The amount of capital is irrelevant, because you should have an entry and exit plan on every trade. Remember it doesn’t matter whether you invest 3k or 50k.

People often look to buy hot penny stocks because of their low price and the ability to own large share amounts with only a small amount of capital. Penny stock buyers should know that trading strategies should be the same, regardless if you are buying Cisco Systems (NASDAQ:CSCO) or a mining stock on the OTCBB. The amount of capital is irrelevant, because you should have an entry and exit plan on every trade. Remember it doesn’t matter whether you invest 3k or 50k.

Please keep in mind that not just any trading concept will work. Sometimes having no plan might be just as good as having no plan at all. So here are some simple suggestions that should keep you out of trouble and hopefully be cornerstones in your thought process.

Always trade small until you achieve a certain comfort level. Being comfortable as an investor is being consistently profitable. So take your time, good ideas come around all the time. CNBC, the Wall St. Journal and various trading and penny stock newsletters have winning trades often. So don’t be afraid to miss one before you gain the necessary experience. Trust me other good ideas will come again.

Another common mistake made by traders and investors is using margin. In my opinion, trading on margin is not only extremely risky because you can actually lose more than you initially invested, but it also alters your mental psyche during the trade. So never put a stock like General Electric (NYSE:GE) on margin to buy a penny stock. No matter how good it sounds.

You should also look for solid companies. While it is not common for a company trading on the OTCBB to be profitable, you can look for other signs. Start with looking for companies with revenues or contracts. Especially companies that have aligned themselves with major corporations or governments. This often validates a companies prospects.

Finding liquid penny stocks can also be somewhat difficult. It is human nature to want to be first and buy a stock while everyone else is sleeping. But this is usually a losing game. A simple rule to use is to never invest more than half of the average dollar volume that a stock trades. For instance if a $1 stock only trades 10 thousand dollars in volume on average, don’t buy more 5 thousand dollars worth. Novice investors don’t realize that small orders can move some illiquid penny stock names 5% with ease. This is part of building an both an entry and exit strategy. Not using market orders is the best way to avoid getting a bad execution.

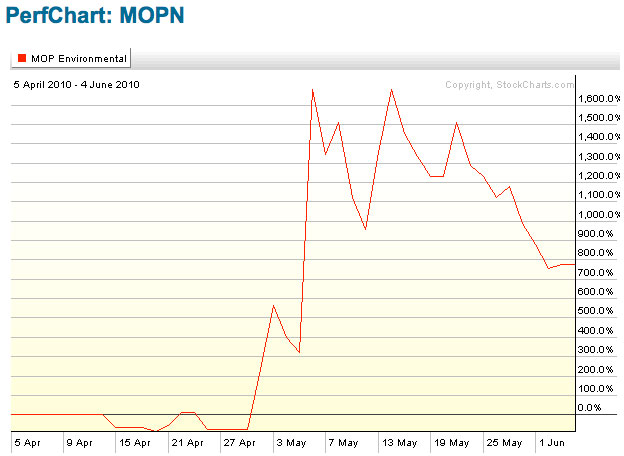

The last point is another common mistake to avoid. Don’t buy stocks that gap up. Many professional traders and hedge fund managers “fade” or counter trade gaps. Market makers have made fortunes short selling capitulation moves to the upside in penny stocks. Think about the last time you bought a gap up and the stock went down quickly. Did you ever stop to think of who was on the other end of the trade ? Why do you think these trading firms are in business ? To lose money. So if you really like a stock that gaps up, put a limit order in below and wait for it to retrace.

Lastly, do your research. We always tell you to be prepared. Having knowledge about a company is not a guarantee to a profit, but it surely eliminates bad investments. The internet has leveled the playing field between retail and institutions to some degree. So take the extra hour and simply browse the web for PR’s and financials. Remember, preparation is a key to avoiding rash decisions.

What we do know is that large amounts of speculative money was invested in China and in Chinese stocks. These investors were looking for massive gains too. Recent losses overseas may cause the “hot” money to be a little less aggressive. As we all know it is easier to find

What we do know is that large amounts of speculative money was invested in China and in Chinese stocks. These investors were looking for massive gains too. Recent losses overseas may cause the “hot” money to be a little less aggressive. As we all know it is easier to find

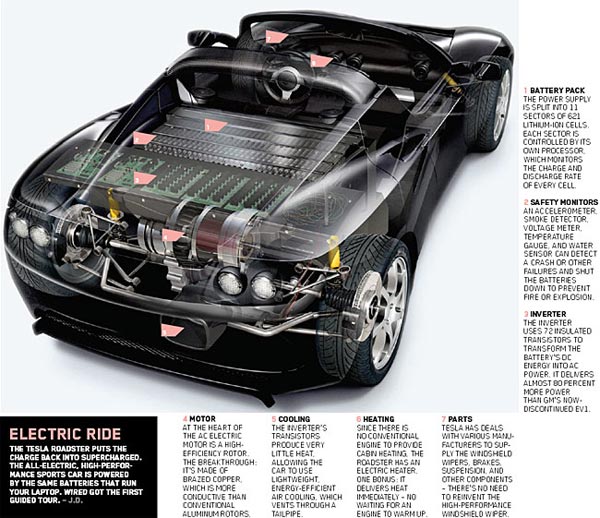

The much anticipated Tesla Motors IPO will begin trading on Tuesday. Goldman Sachs, Morgan Stanley, JP Morgan and Deutsche Bank are the lead underwriters. The offering has also increased in size due to demand for the shares. However, Tesla is the classic concept stock and has never turned a profit. Does that matter ? Probably not.

The much anticipated Tesla Motors IPO will begin trading on Tuesday. Goldman Sachs, Morgan Stanley, JP Morgan and Deutsche Bank are the lead underwriters. The offering has also increased in size due to demand for the shares. However, Tesla is the classic concept stock and has never turned a profit. Does that matter ? Probably not.