Biotech Stocks To Buy?

Sanofi-Aventis (NYSE-SNY) now has approval from the board of directors to offer as much as $70 per share for Genzyme (NASDAQ:GENZ). This equals roughly $18.7 billion for the transaction. Last week we mentioned that the Biotech ETF (NYSE:BBH) was a more conservative way to take advantage of the GENZ takeover rumor.

Sanofi-Aventis (NYSE-SNY) now has approval from the board of directors to offer as much as $70 per share for Genzyme (NASDAQ:GENZ). This equals roughly $18.7 billion for the transaction. Last week we mentioned that the Biotech ETF (NYSE:BBH) was a more conservative way to take advantage of the GENZ takeover rumor.

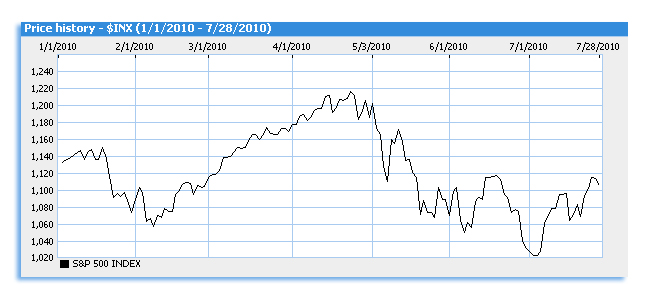

History tells us that a high profile takeover of a company like GENZ usually spurs interest within the particular sector. This interest also can trickle down from the NYSE to the OTCBB as speculative money is getting freed up with the turn in the markets.

Volatile and super liquid bio-pharma stocks like Rexhan Pharmaceuticals (AMEX:RNN) and Neostem, Inc. (AMEX:NBS) may see increased activity as well. It has been proven that “most” start up biotech stocks don’t work in the long term. Most investors know that if they want a core biotech holding for their portfolio, they will look at companies like Amgen (NASDAQ:AMGN) or they can simply buy a biotech ETF or a sector mutual fund. Most penny stock and small cap investors are looking for a speculative “home run”.

The potential takeover frenzy in the biotech space may or may not materialize. This is why penny stock investors and traders need to be nimble. In the next few weeks you might see constant PR’s coming from many different biotech penny stocks. Especially since commodity stocks have been beat up recently and many mining penny stocks have lost their luster recently.

The key now is finding these low priced biotech stocks. The best thing to do right now is form a penny stock list that features some different biotech names. Then look for companies with some cash and low burn rates. Then monitor news on large cap biotechs and general sector news as well. Keep in mind that this positive news cycle may not last. If it does……great, but if it doesn’t you have to be prepared to get out of the trade breakeven or at a small loss. So the best way to approach this trend might be as a trader not an investor. Remember there are penny stock flippers out there who trade these types of trends for a living. So be prepared, do your homework and remember to only commit a portion of your liquidity to an idea.

Biotech company Genzyme (

Biotech company Genzyme (